Transforming Secure Banking Portal with User-Centric Design

Objective:

Revolutionize the payments portal for ICS (Institutional Client Services) clients, ensuring secure document delivery to the relationship team while enhancing client self-service functionalities for future scalability.

Outcome:

The secure banking portal underwent a transformative overhaul, bolstering security and enhancing user experience. Implementation of multi-factor authentication and streamlined document upload features mitigated fraud risks and facilitated user navigation. Positive feedback from pilot customers validated the portal's effectiveness in addressing user needs, while fostering a collaborative and user-centric culture within the organization. Ongoing iterative improvements ensure sustained value and drive continued growth for ICS and its clients.

Challenge:

Traditional methods of document exchange via email posed security risks, leading to potential fraud and inefficiencies in verification processes. The aim was to mitigate these risks by creating a robust and user-friendly portal.

My Role:

As the lead product designer, I spearheaded two scrum teams, facilitating collaboration between stakeholders, engineers, and the product owner. Beyond design deliverables, I focused on enhancing team agility and health.

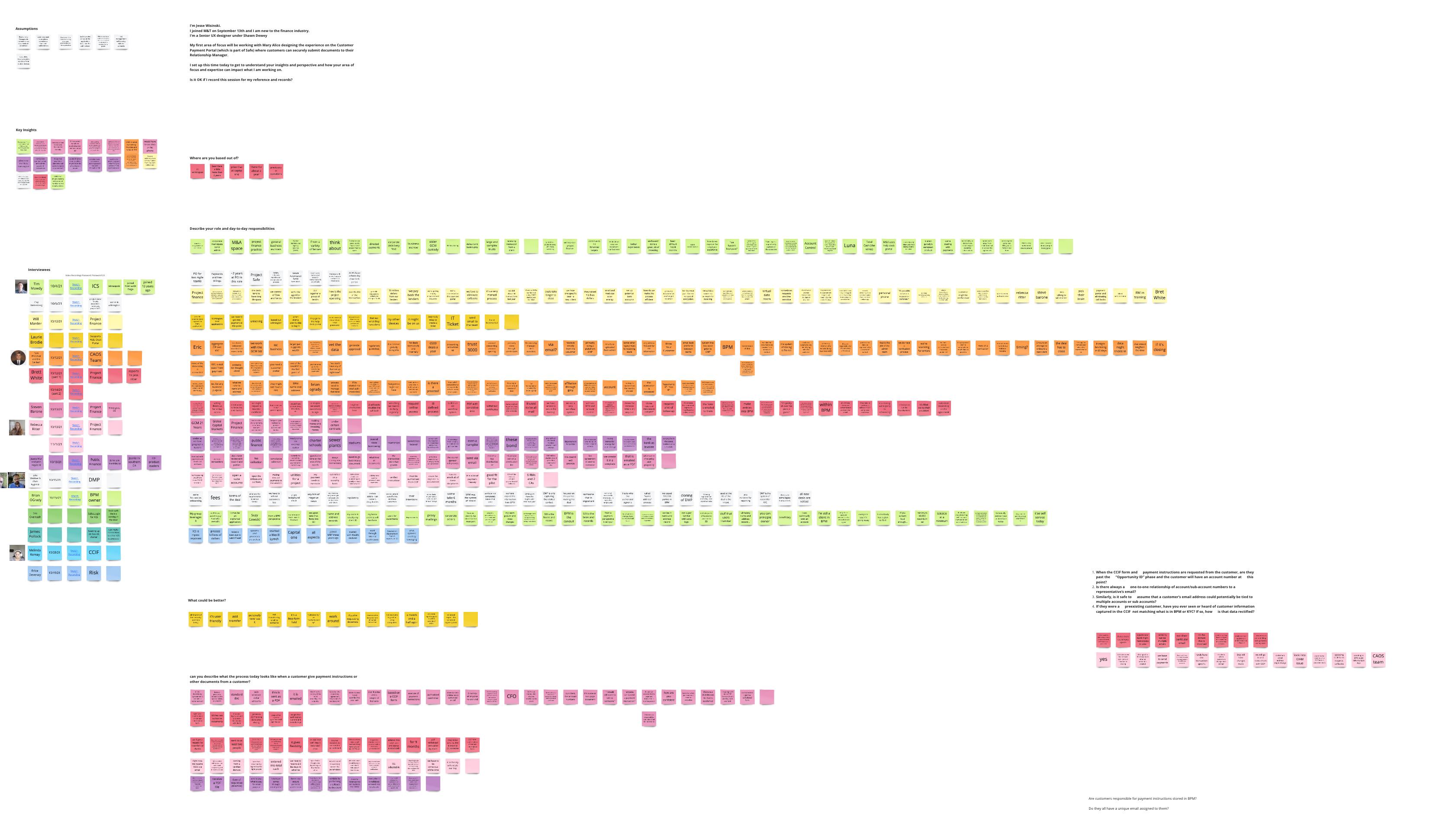

Research & Discovery:

Conducting extensive interviews with stakeholders and end-users revealed critical insights, dispelling misconceptions and uncovering hidden business and technical challenges. Remote interviews via Webex and meticulous note-taking on Miro facilitated efficient clustering of findings.

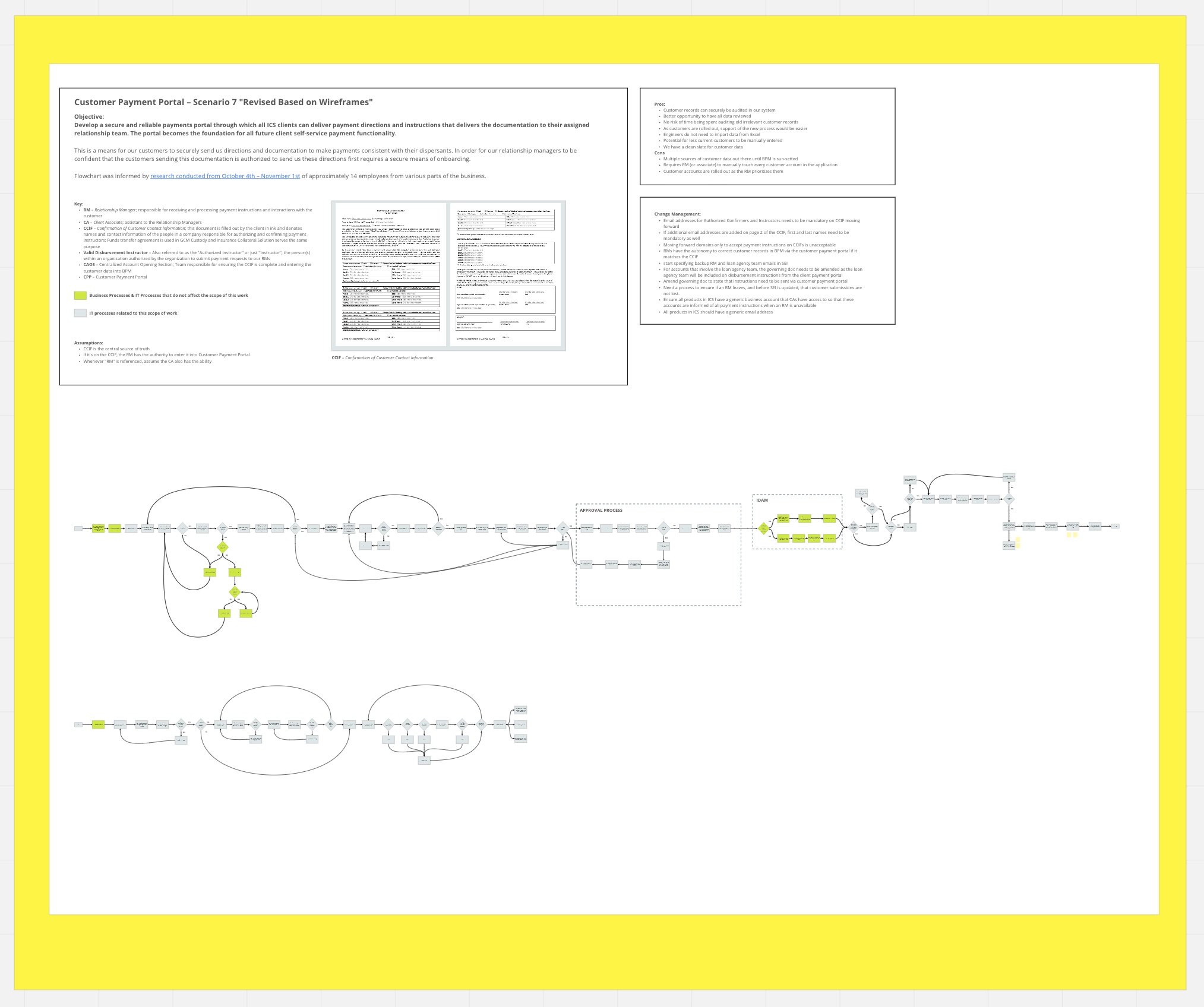

Workflows:

Crafting comprehensive workflows explained the intricacies of existing processes, surfacing issues such as data inconsistencies and outdated practices. These visualizations served as invaluable communication tools for aligning stakeholders.

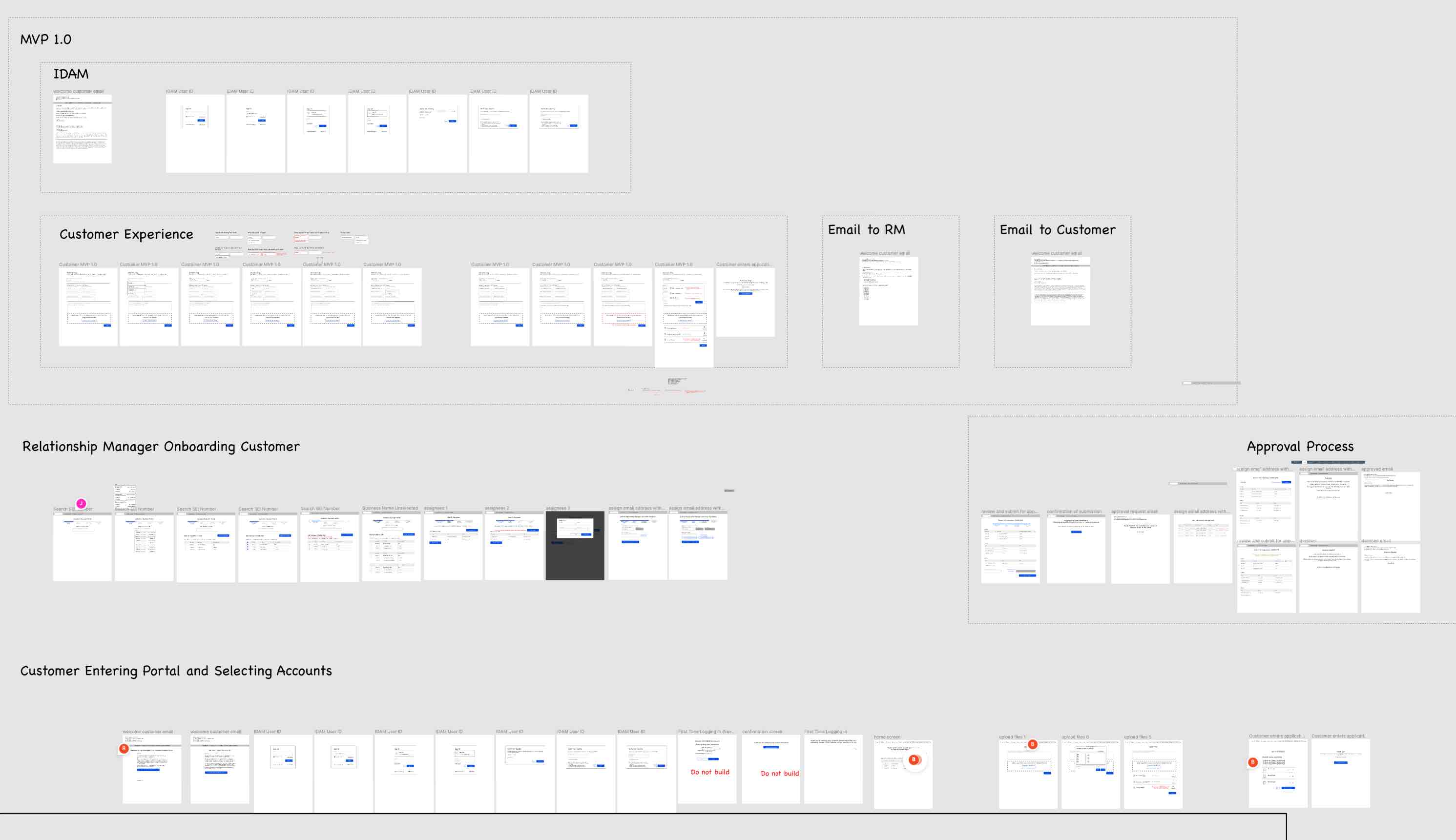

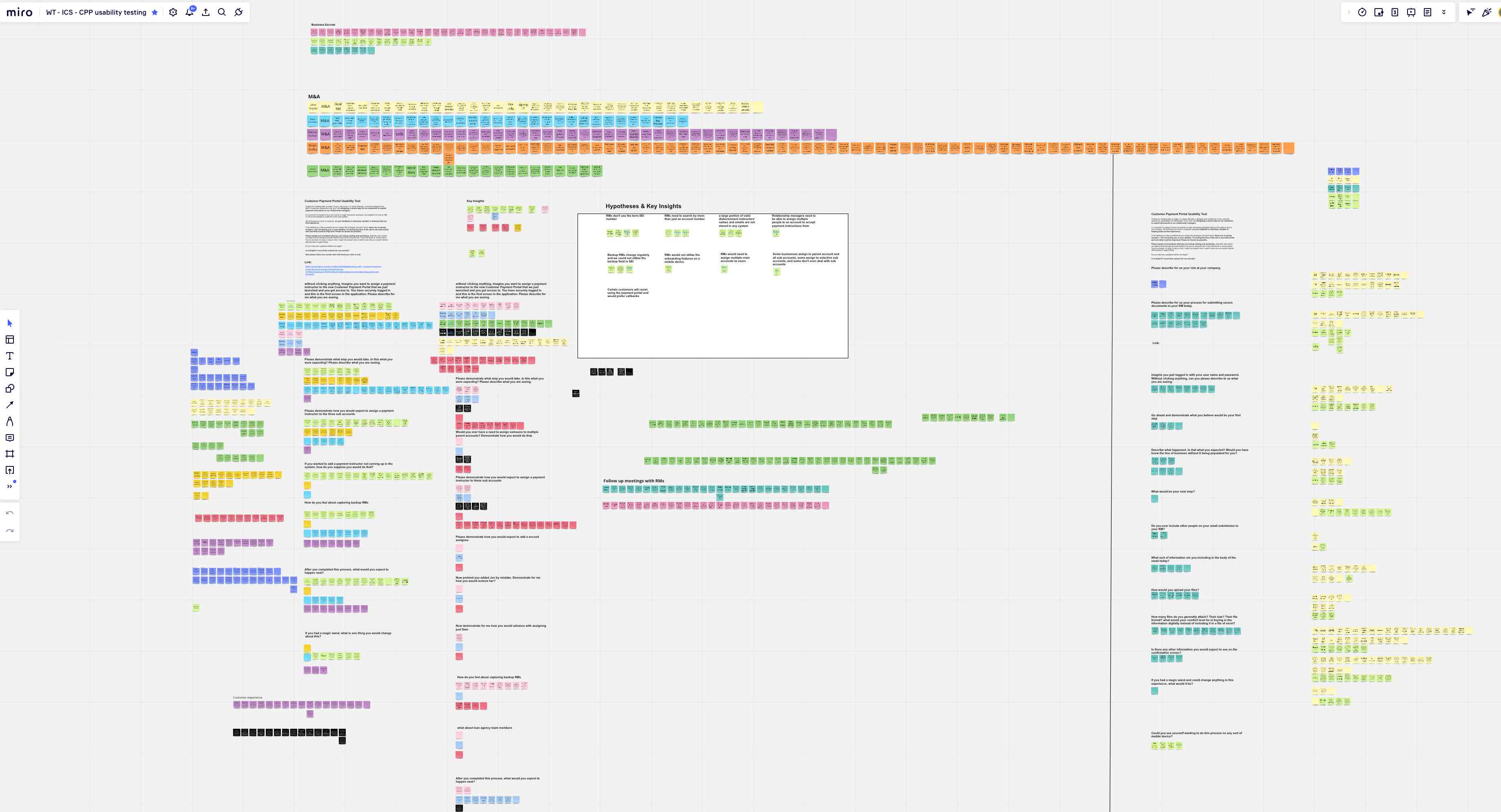

Design & Usability Testing:

Embracing Lean UX principles, I prioritized iterative prototyping and collaborative design. Lo-fi Figma prototypes facilitated early-stage user testing, fostering real-time feedback loops and empowering engineers to understand user needs firsthand.

Accessibility:

Championing accessibility from inception, I engaged accessibility experts early in the design phase. By integrating accessibility standards into the prototyping process, we ensured inclusive design practices and minimized rework.

This portal marked a milestone as the business's inaugural WCAG-compliant application, guaranteeing inclusivity for customers with disabilities. As a testament to this achievement, I received recognition with a Special DEI (Diversity, Equity, and Inclusion) Award.

MVP Release to Pilot Customers:

The MVP release streamlined document upload processes, integrating multi-factor authentication and predictive search functionalities. Despite an additional step for users, the time saved in deployment outweighed the complexity of building new systems.

Measuring Outcomes & Next Steps:

Adopting an outcomes-focused approach, we implemented a post-launch customer survey to gather feedback and quantify success metrics. Initial feedback and anticipated time savings for relationship managers underscore the potential impact of the redesigned portal.

Other Contributions:

Recognizing the need for centralized documentation, I established standardized processes in Confluence, ensuring seamless knowledge transfer and enhancing team collaboration.

Through strategic design interventions and iterative refinement, the secure banking portal evolved from a compliance-driven solution to a user-centric platform, poised to deliver tangible value to both clients and the organization.

Together, we transformed challenges into opportunities, paving the way for a more secure, efficient, and user-friendly banking experience.